On your quest to find the perfect credit card, Truist Credit Cards shine brightly. They emerged from BB&T and SunTrust joining forces.

Truist has a wide selection of credit cards. Whether you want cashback rewards or travel perks, this guide helps.

It will show you how to pick a card that fits your life, offering both safety and ease.

Check out the exclusive ones for you

Ver todas as ofertasGoldman Sachs Card

Limit up to 15.600

Free Annual Fee

🎁 5 benefits for you

Morgan Stanley Card

Limit up to 23.500

Free Annual Fee

🎁 7 benefits for you

Let's look at the best options and see how these cards can benefit you.

Key Takeaways:

By clicking the button you will remain on this website.

- Truist Credit Cards offer a range of options tailored to various financial needs.

- Understanding your spending habits is crucial for selecting the best Truist credit card.

- Rewards credit cards from Truist provide enticing benefits for everyday spending.

- Cashback cards can maximize your earnings on purchases you make regularly.

- Evaluating the features of Truist cards can lead to significant savings and rewards.

Understanding Truist Credit Cards

Learning all about Truist credit cards is important for smart decisions. Truist Bank has several credit card options. These cards cater to different needs and preferences.

You can find cashback, travel rewards, or secured cards at Truist. These options are made to fit your lifestyle well.

Truist credit cards come with great features. You’ll get good interest rates, easy online management, and rewards. It's helpful to know these features to choose the right card for you.

Before getting a Truist credit card, look at the terms carefully. Your credit score plays a big role in approval and credit limits. Knowing this helps you get the most out of Truist credit cards.

| Credit Card Type | Key Features | Ideal For |

|---|---|---|

| Cashback Card | Earn cashback on everyday purchases | Regular shoppers looking for savings |

| Travel Rewards Card | Points on travel-related expenses | Frequent travelers seeking rewards |

| Secured Card | Build or rebuild credit history | Individuals starting their credit journey |

Benefits of Choosing Truist Credit Cards

Truist Credit Cards have many benefits that appeal to lots of people. They let you earn plenty on what you buy every day. For example, you can get 3% cash back on gas and EV charging with these cards. This helps you get more rewards based on how you spend.

Truist also gives you options to customize your rewards. You can choose to get cash back on things like food, eating out, or trips. They also offer travel insurance and protection for your buys. These perks make Truist cards even more valuable.

It's easy to handle your account with their mobile banking. Plus, their customer service is top-notch. Truist is a great choice if you want easy access and real value from your credit card. Their cards offer a lot of financial freedom and rewards that fit your spending style.

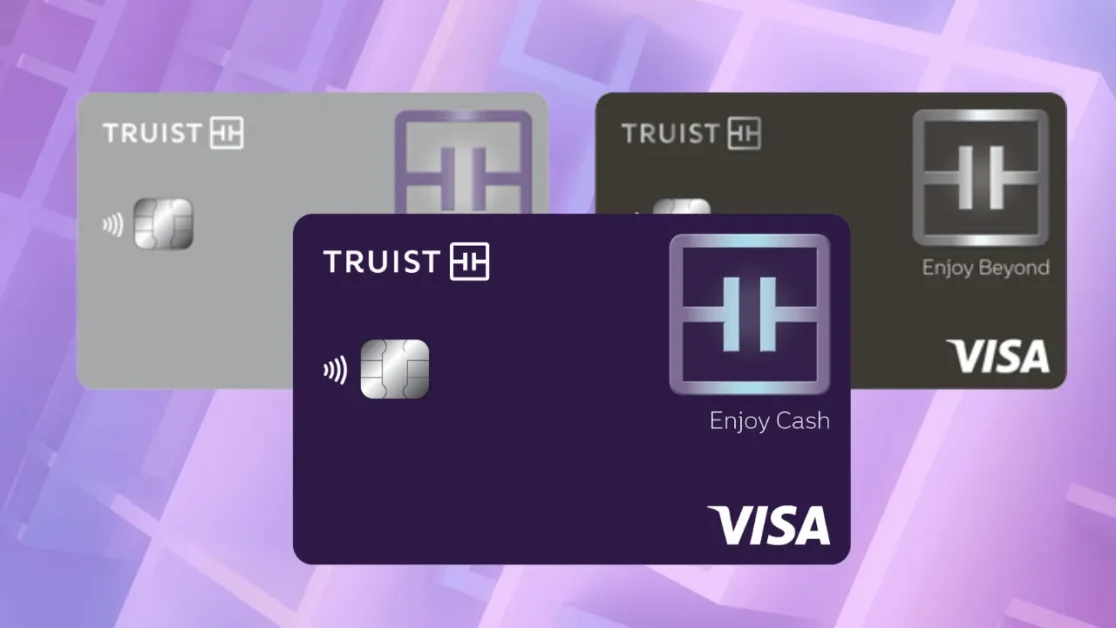

Popular Truist Credit Cards

Truist offers a range of credit cards to suit different needs. Each card has special features, making them popular among various users.

The Enjoy Cash credit card gives great rewards for daily purchases. You get 3% cash back on gas, 2% on groceries, and 1% on everything else. It's a top pick for those who spend a lot on these items.

Travel buffs will love the Enjoy Beyond credit card. It provides excellent rewards for travel spending. If you travel often, this card can make your trips even better with its perks.

The Truist Future credit card is for those thinking ahead. It offers benefits for big life plans. This card is perfect for folks who like to plan their financial journeys with care.

| Card Name | Rewards Structure | Ideal For |

|---|---|---|

| Enjoy Cash | 3% cash back on gas, 2% on groceries, 1% on other purchases | Daily shoppers |

| Enjoy Beyond | Higher rewards on travel spending | Frequent travelers |

| Truist Future | Flexible benefits for life events | Those planning for the future |

Exploring these cards helps you find the right match for your financial goals. Truist has options for everyone, whether you want cashback or rewards for travel and planning ahead.

By clicking the button you will remain on this website.

How to Maximize Your Rewards with Truist Credit Cards

Start by picking categories like groceries, gas, and utilities to earn the most rewards with your Truist card. Each card has different rewards, so knowing the best categories is key. This way, you can make the most of what you earn.

Use smart spending strategies to boost your rewards. Set limits for yourself in the card's best categories to earn as much as possible. Getting alerts can help you keep an eye on your spending. This makes sure you stay eligible for the most rewards.

Check your monthly statements to understand your earning habits. With this info, you can tweak your spending as needed. Truist's online tools and apps are great for keeping track of rewards. By spending wisely and managing well, you can get more cashback. This lets you fully enjoy your Truist credit card.

| Category | Typical Rewards Rate | Tips for Maximizing Rewards |

|---|---|---|

| Groceries | 3% Cashback | Shop during bonus promotional periods |

| Gas | 2% Cashback | Use at specific gas stations for added bonuses |

| Utilities | 1% Cashback | Automate payments to ensure timely transactions |

| Dining | 2% Cashback | Choose restaurants participating in loyalty programs |

Comparing Truist Credit Cards to Other Options

Looking at credit cards, we need to compare Truist with others carefully. Doing so shows us how Truist matches up in rewards, welcome bonuses, fees, and service.

Truist has various credit cards for different needs. For example, Chase and American Express offer great rewards too. Some of their cards may have better rewards or perks for traveling or getting cash back, even if Truist has cards with no annual fee.

When picking a credit card, look at four main things:

- Reward rates on purchases

- Sign-up bonuses for new customers

- Annual fees associated with each card

- Customer service ratings and accessibility

Many say Truist has excellent customer service, which is key if you need quick help. But, if travel perks are what you're after, other cards might be a better pick.

In the end, knowing the differences helps you see where Truist stands. This knowledge is crucial for choosing a card that meets your money goals.

Application Process for Truist Credit Cards

Getting a Truist credit card involves a few steps. It's all about having the right papers and meeting the criteria. This guide helps you increase your chance of getting approved.

First, make sure you have this info ready:

- Personal identification, such as a driver's license or passport

- Social Security Number (SSN)

- Income details, including employment information

- Monthly housing payments and any existing debts

Now, get your documents ready and head to the Truist website. There, you'll find an easy application to fill out. Your credit score is key here. A better score can mean a higher chance of getting your card.

After applying, the wait time for a decision can be quick or take a few days. It depends on how well you filled out your application and the bank’s process. Following these guidelines can make getting a Truist credit card smoother.

Conclusion

Truist credit cards come with many benefits, making them a great choice for managing money. To choose the right one, think about how you spend and what rewards you want. Truist has cards for cashback, travel, and more, fitting different needs.

To get more from your card, use strategies like bonus offers and spending wisely. Understanding how to handle your card can help you benefit more over time. This makes Truist cards stand out from others.

Choosing a credit card is a personal decision. With the right info, you can pick the best one for you. Consider what's important to you. A Truist card can help you meet your financial goals.

By clicking the button you will remain on this website.

FAQ

What types of credit cards does Truist offer?

Truist has a range of credit cards. You'll find cashback cards, travel rewards cards, and secured cards. They are meant to suit different spending habits and financial aims.

How do I choose the best Truist Credit Card for my needs?

Think about where you often spend your money, like groceries, gas, or travel. Then, pick a card that gives you rewards for those expenses. This way, you get more back from your spending.

What are the benefits of using a Truist Credit Card?

Truist Credit Cards offer cashback, rewards tailored to you, travel insurance, and purchase protection. You also get easy-to-use mobile banking. Plus, you can earn big rewards on daily purchases.

Are there any fees associated with Truist Credit Cards?

Yes, some cards from Truist might have annual fees or fees for foreign transactions. It's key to check each card's terms and conditions to know about any costs.

How can I maximize my rewards with Truist Credit Cards?

To get the most from your cards, pick ones that boost earnings in your main spending areas. Set up alerts and check your account often. This makes sure you're getting the best rewards possible.

How does Truist Credit Cards compare to other credit card options?

You can compare Truist Credit Cards with others by looking at their rewards, bonuses, fees, and customer service. By evaluating these, you'll see what Truist offers that meets your needs.

What is the application process for Truist Credit Cards?

Applying for a Truist Credit Card means filling out an online form, providing needed documents, and meeting qualifications. Check your credit score first to better your approval odds.

How long does it take to get approved for a Truist Credit Card?

Approval times can vary. Generally, expect a decision from a few minutes to a few days after applying. This depends on your credit status and which card you choose.